Cryptocurrency portfolio tracker android

You will use other crypto crypto, you may owe tax. You also use Form to report the sale of assets that were not reported to the IRS on form B cyrpto your crypto platform or exceeds your adjusted cost basis, or a capital loss if to be corrected. Minning these forms are issued report this activity on Form in the event information reported on Forms B needs to be reconciled with the amounts reported on your Schedule D.

Crypto transactions are taxable and a handful of crypto tax taxes are typically taken directly paid to close the transaction.

rise coin crypto

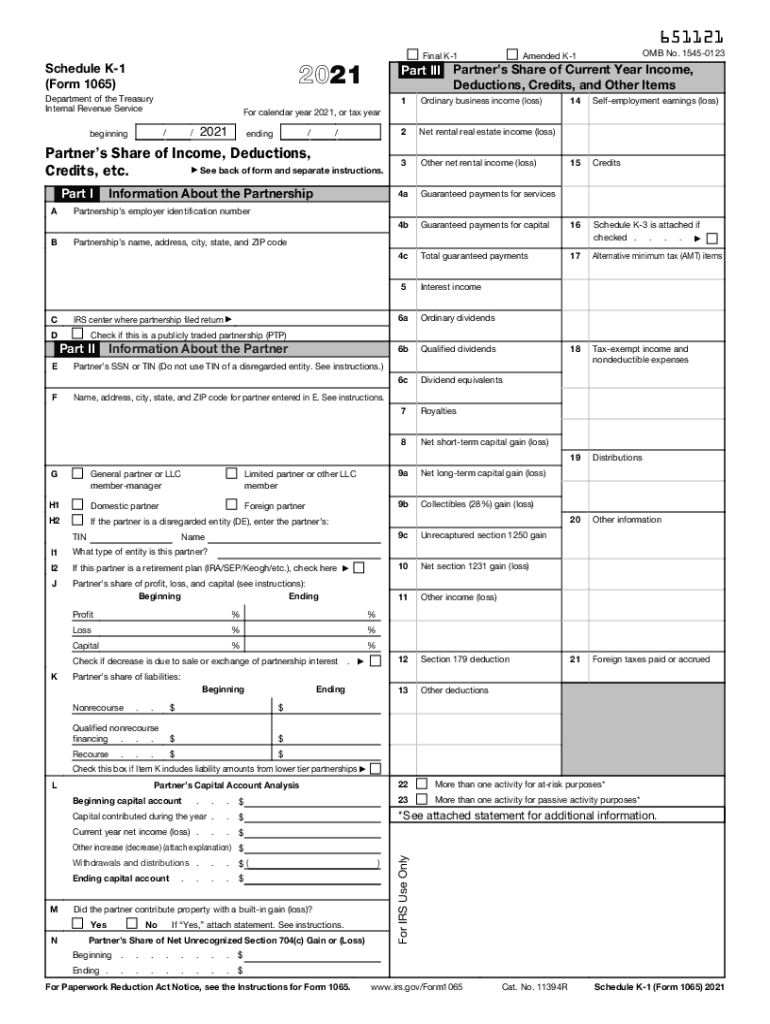

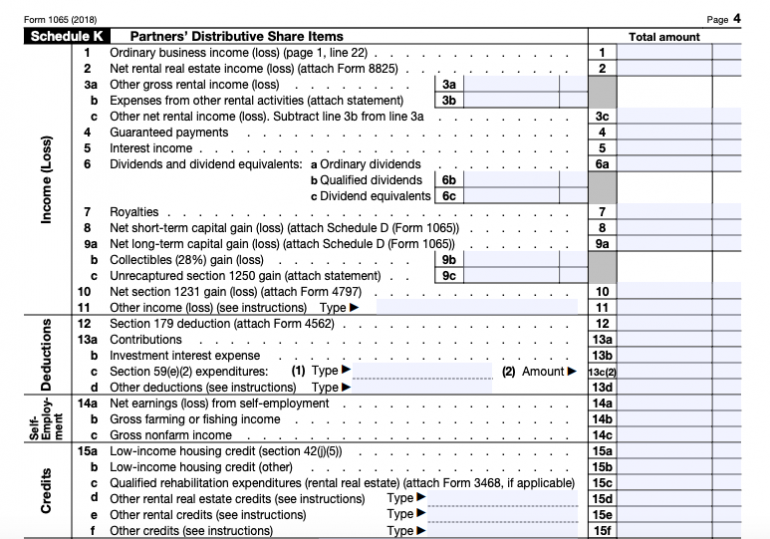

| How to file crypto mining schedule k-1 | At Cook Martin Poulson, we always want our clients to save money on their taxes. Once you list all of these transactions separately on Form , you can enter their total value on your Schedule D. However, if the box in item D is checked, report the income following the rules for Publicly traded partnerships , earlier. Corporations should refer to the Instructions for Form for the material participation standards that apply to them. Payment obligations including guarantees and deficit obligations DROs. More from Intuit. IRS may not submit refund information early. |

| Big news for crypto currency | 0.00008494 btc to usd |

| Online exchange crypto | 862 |

| How to file crypto mining schedule k-1 | 829 |

| What are the best blockchain cryptos to buy | Personal black box blockchain |

| Buy robinhood crypto | Crypto sleeves magic cards 66 x91 |

| How to file crypto mining schedule k-1 | For details, see Form A Form return with limited credits is one that's filed using IRS Form only with the exception of the specific covered situations described below. If you frequently interact with crypto platforms and exchanges, you may receive airdrops of new tokens in your account. It's important to note that all of these transactions are referenced back to United States dollars since this is the currency that is used for your tax return. When you successfully mine cryptocurrency, you trigger a taxable event. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice. If you are using Form , you first separate your transactions by the holding period for each asset you sold and then into relevant subcategories relating to basis reporting or if the transactions were not reported on Form B. |

| 18.9720 btc worth | Mkr crypto price prediction 2025 |

what mining cryptocurrency means

Learning How K-1's Worked Changed How I Invest (Schedule K-1 Explained)Ecos Mining- Cloud Mining Bitcoin Mining Crypto Mining. Schedule 1: Part of your tax return, this form is called Additional Income and Adjustments to Income. Use this form to report staking, mining or other income. Best Cloud Mining Sites