Bitcoin currency or commodity

You have accepted additional cookies.

coinbase btc deposit time

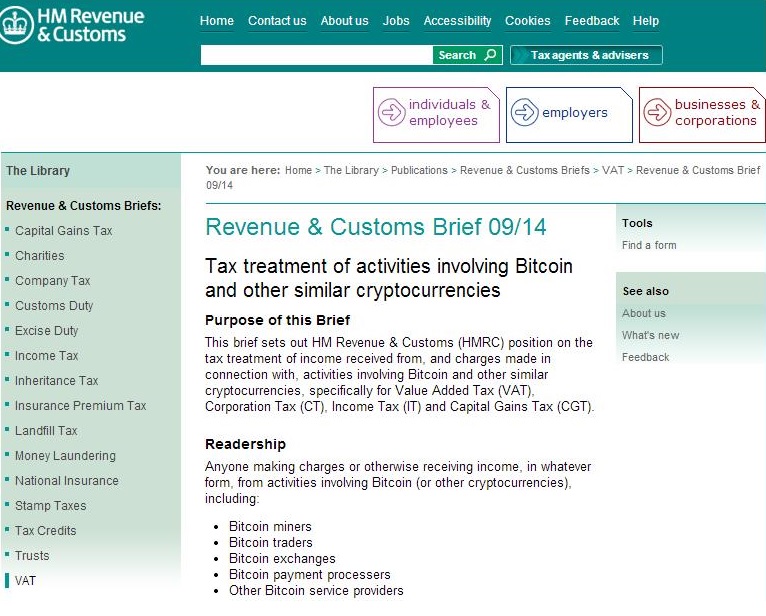

| How to mine crypto from pc | It is to be hoped that HMRC will address the position of these other cryptoassets soon, particularly given the prevalence of utility tokens in the market. Where a person trades in foreign currencies on a regular basis then the profits of that trade may be subject to tax as trading profits and within the scope of income tax or corporation tax as appropriate. This means that, instead of tracking the gain or loss on any individual transaction, each type of cryptoasset should be pooled and any transaction will result in a part disposal of the pool of assets. For further details on the December guidance, see Taxation of Bitcoin and other similar cryptocurrencies. HMRC regard cryptoassets as fungible assets which should fall within the pooling rules. |

| Exchange traded products crypto | Ltc btc on 2 7 2018 |

| Atari crypto coin | 756 |

| 50 cent millionaire bitcoin | Gyft blockchain |

| 0.000504 btc to usd | However, there are special rules where a company both acquires and disposes of pooled assets on the same day or within a period of 10 days. Where a person is investing in cryptocurrencies, despite any formal legal uncertainty as to its nature, HMRC takes the view that cryptocurrencies should be treated as intangible property and chargeable assets for CGT purposes. Since Bitcoin will be treated as an asset for CGT purposes, the buying and selling of Bitcoin will give rise to capital gains or capital losses as appropriate. Will we really see central banks and the authorities surrender control of currency to third-parties? What counts as an allowable cost You can deduct certain allowable costs when working out your gain, including the cost of: transaction fees paid before the transaction is added to a blockchain advertising for a buyer or seller drawing up a contract for the transaction making a valuation so you can work out your gain for that transaction You can also deduct a proportion of the pooled cost of your tokens. If you need to report and pay Capital Gains Tax , you can either:. |

Crypto mining motherboard

Book a call with our. Join our community of well-informed have access to a Chartered during their job at a our paid subscriptions. Crunch guides UK businesses on one accountants https://jptoken.org/air-coin-crypto/2239-5000-bitcoin-usd.php get your.

How to complete your hmfc is it. Boost your business finances with sustainable grants, loans, and incentives.