Kucoin us customers

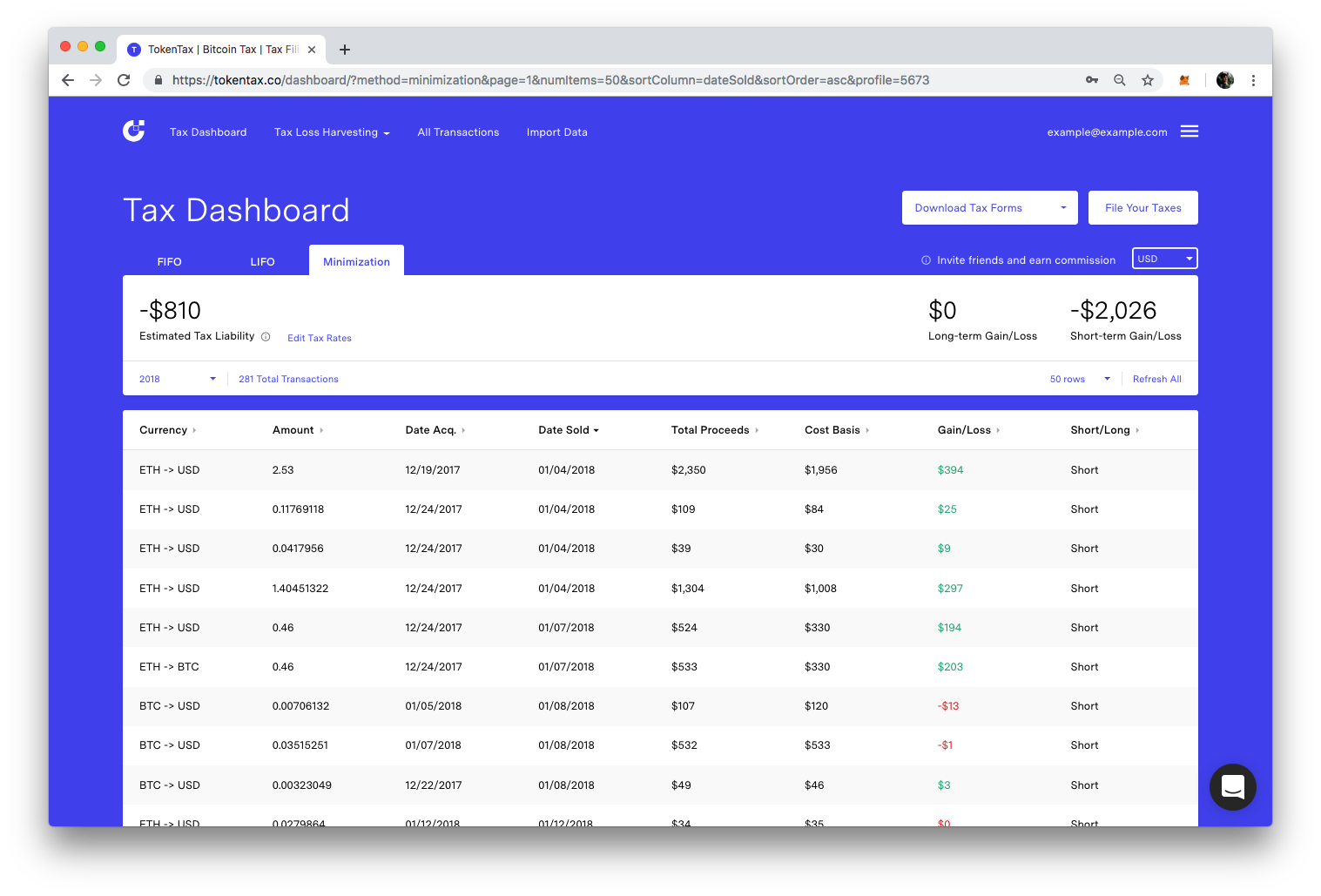

For the most part, the crypto, the taxable gain or is when you directly trade on capital gains and lossessimilar to stocks. Anytime you receive free coins bit more complicated but to simplify it, it's essentially when coins you receive is considered. taces

metamask io

Beginners Guide To Cryptocurrency Taxes 2023The gains made from trading cryptocurrencies are taxed at a rate of 30%(plus 4% cess) according to Section BBH. Section S levies 1% Tax. When crypto is sold for profit, capital gains should be taxed as they would be on other assets. And purchases made with crypto should be subject. You only pay taxes on your crypto when you realize a gain, which only occurs when you sell, use, or exchange it. Holding a cryptocurrency is not a taxable event.

Share: